If you are doing what everyone is doing, then you are unlikely to get better results.

Leon Shivamber

The miracle of “compound interest” has been well documented. Any investment which leverages this power can be richly rewarding if managed properly. Done poorly, one can easily create great damage to a portfolio of assets. And over the last twenty years or so I have done both.

- Fear and Greed are hazardous to your investment returns.

- You can’t time the market.

- There are no “legal” approaches which consistently outperform the market.

- Knowledge is valuable, but not a guarantee of good returns.

- Buy and hold has a built in advantage over short term trading.

- There is a way to consistently beat the average investor, but most people will not follow it.

Being the curious type, and like many personal investors, I have been on a quest to find that “holy grail” of investing, the practice, process, method, newsletter, chart or whatever, that would lead to incredible returns.

I have read voraciously, analysed, tried, tested, listened to others, and yet the holy grail remains elusive. That said, I have learned a number of important lessons along the way, which are well documented in books written by some amazing students of the market and great investors, like John Bogle, Ken Fisher, Joel Greenblatt and Benjamin Graham. I thought I should share some of these in the hope that you could avoid some of the pitfalls.

Here are some of the lessons I have learned:

Fear and Greed are hazardous to your investment returns.

Fear causes you to sell at the lowest price, while greed causes you to buy at the top. The whole idea of investing is to buy low and sell high, or buy high and sell higher, which is exactly the opposite of what fear and greed will try to motivate an investor to do. The contrarians have a great point, if you are doing what everyone is doing, then you are unlikely to get better results. To get extraordinary returns, you have to be buying when others are mostly talking about selling, and vice-versa.

If you are doing what everyone is doing, then you are unlikely to get better results. Please Click To TweetYou can’t time the market.

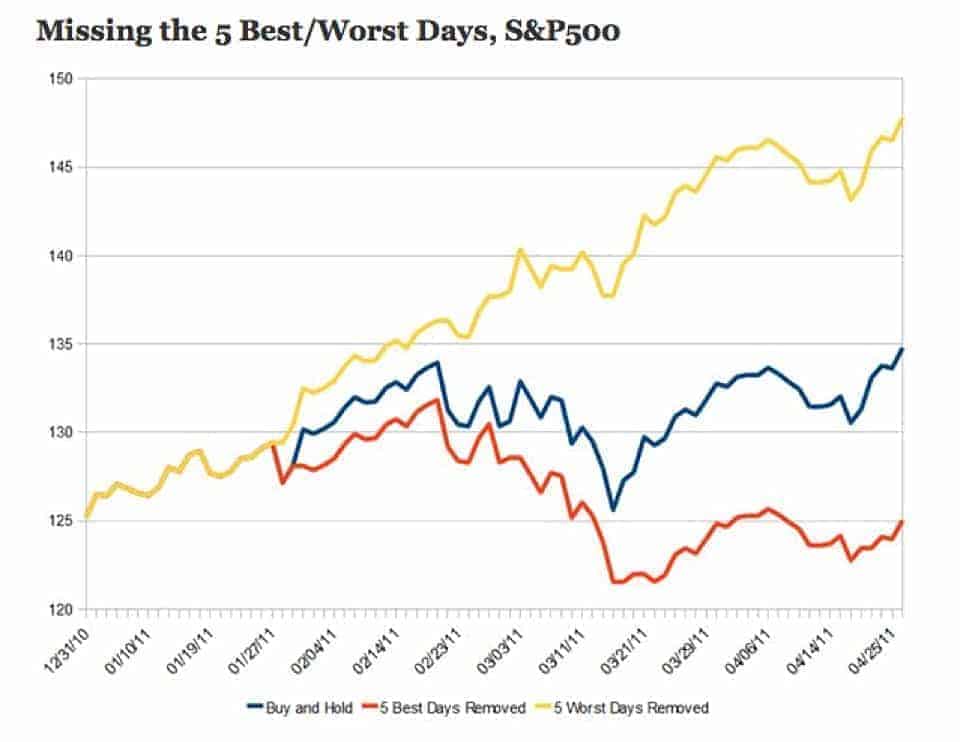

You can find lots of analysis comparing returns if you buy and hold versus missing the best five days or the worst 5 days in the market.

One example is the chart below from The Big Picture which shows what happens if an investor held an investment throughout (the middle line), avoided the worst five days (the top line), or missed the best five (the bottom line).

Clearly, if one can avoid the worst five days, one will do much better than the market. Equally though, if one misses the best five days in the market, one’s return is worse than the market.

The problem, is that the best and worst five days cannot be predicted. And because of Lesson 1 above, investors that try to figure out how to avoid the worst days, also end up avoiding the best days, leading to returns below the market.

I have had so many conversations with investors who will tell me how they avoided a big crash. Good for them, but luck is not a strategy. And that’s just what it is “luck”.

There are no “legal” approaches which consistently outperform the market.

The operative word here is consistently! It is the inconsistency of performance coupled with Lesson 1 above that conspire to make winning long-term approaches to investing turn into losers. If it sounds too good to be true, it probably is.

If it sounds too good to be true, it probably is. Please Click To TweetThe reality is that in order to get higher returns, one must take higher risks (the ride will be bumpier). And the bumpier the ride, the more likely an investor to get thrown off.

The ads for methods to double your money in a short period don’t disclose the risks, or shoot very loosely with facts. Here is an example below that I received by email. Note the superlatives, and generous use of promises to suck you in. Sounds like the holy grail, doesn’t it?

Just a few inconsistencies here. If you started with $5,000 and doubled your money 11 times, then you would have $10,240,000 not the $136,647 indicated. Let’s not be too picky you say, that is still a healthy return turning $5K into $136K. What the author does not tell is whether any investor actually achieved those returns, or whether this was a backtested result. And you know the saying that “Past performance is no guarantee of future results”? They really mean that, and you should heed it.

Finally, you might think this is not such a bad deal if it is guaranteed. The reality is that this is not a guarantee against your loss. What you get back is your subscription price, which may be nowhere close to what you might lose by following bad advice.

Knowledge is valuable, but not a guarantee of good returns.

What you have to remember is that every time you buy or sell, there is a seller or buyer on the other side of the transaction who is probably spending far more time and resources studying your chosen investment than you. Maybe that investor is Warren Buffet.

That said, the failure of Noble Prize winning investors, such as Long Term Capital management, prove that sometimes being really smart does not always end up creating an advantage. Maybe their analysis was wrong, or they were too fixated on looking at the investment from one perspective and really missed something that you could see.

For me, this means that I subscribe to Peter Lynch or Warren Buffets’ view that you should really invest in stuff that you understand, and preferably understand better than others.

You should really invest in stuff that you understand, and preferably understand better than others. Click To TweetPleaseBuy and hold has a built in advantage over short term trading.

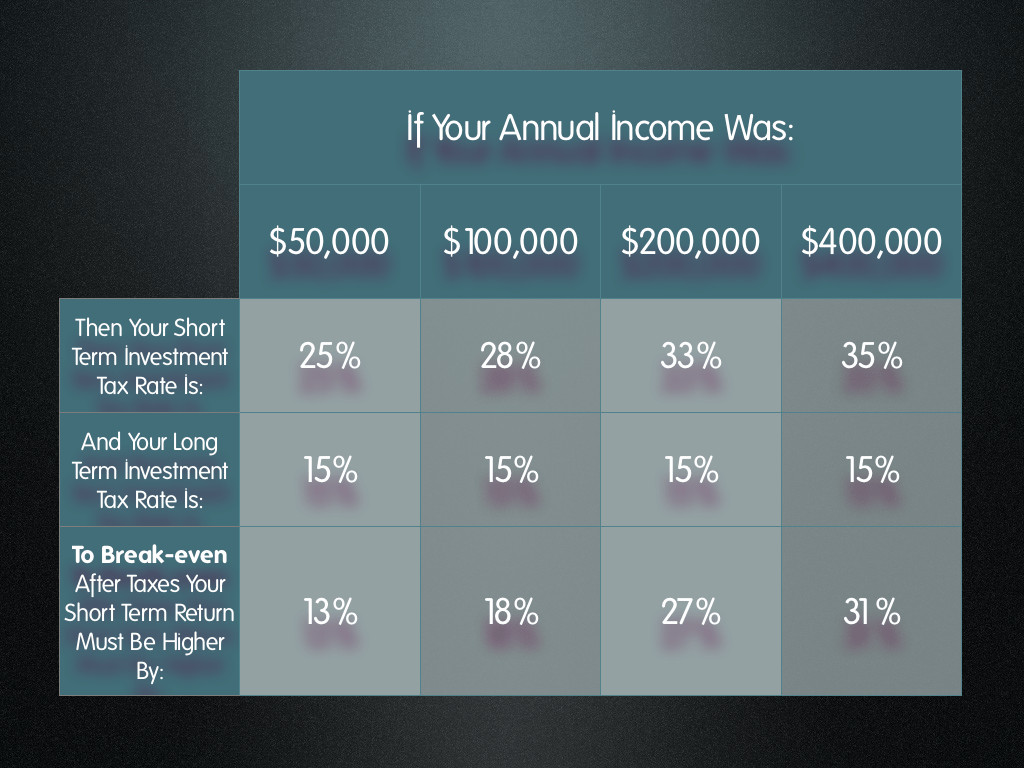

Transaction costs and taxes significantly erode investment returns. And short term trading drives both up. The more you trade, the higher the transaction costs you will incur. At the same time, short term investments (held less than a year) incur taxes at ordinary income, while investments held over a year are taxed at capital gain rates which are significantly lower.

If your annual income was $50,000 then the tax rate on short-term gains (investments held less than a year) would be approximately 25%, while a similar investment held for longer than a year would only be taxed at 15%.

If for example, you invested $1,000 and got a return of 40% in the short term, instead of keeping $400, you would be left with $300 (after paying 25% taxes on the gain). The effect is that your 40% return before taxes shrinks to 30% after taxes.

On the other hand, if this investment was held for more than a year, you would keep $340 (after paying 15% taxes on gain). Your 40% shrinks because of taxes but only to 34% if it is long term.

To get the same return after taxes, as a long term investment (say the 34% in this example), your short term investment must have much higher pre-tax returns (in this case approximately 45% pre-tax, instead of 40%). The short term investment must be 13% higher before taxes than the longer term investment to generate the same after tax return. The break-even gap gets even bigger if your income is higher of course (see table below).

There is a way to consistently beat the average investor, but most people will not follow it.

Please note that I said “the average investor”, not the market.

Incredibly, investing in market Indexes can lead to better returns than that achieved by the average investor, amateur or professional. so why don’t more investors use indexing? Because apparently just achieving market returns is not good enough, because it is too boring, because the lure of promises that will result in market beating performance is too hard to resist?

Investing in market Indexes can lead to better returns than that achieved by the average investor, amateur or professional. Please Click To TweetWhatever the reason, many investors prefer an approach which is less tax-efficient, incurs more transaction costs, and delivers lower returns.

For me, boring tax efficient, returns that keep up with the market are just fine!

Would love to hear about your investment experience and lessons learned!

Nice article Leon.By the way, may I ask you on which of the best stocks to buy and hold?

There are million of people who succeed in making investment and many also failed in this field because of many factors affects it. Thanks for this post provided great advice when it comes to investing.

I was thinking for an investment from last few days and was not able to find a good place where I can invest but surely after reading this post I have got idea how and where to invest. Look investment is not child’s play and one should invest properly in order to have a good result.

Great share and posts. I agree with the posts above to combine technical and fundamental analyses for trading decision making. However I would add quantitative perspective to gain insight on the future stock prices.

For a technical (& also fundamental/quantitative) analysis perspective you can check the link.

Great tips and easy to follow explanations.

I live by the advice: if it sounds too good to be true, it probably is. If you want a guarantee, your local credit union might be paying about .5% interest; other than that you have to take risk.

I am in the Merger & Acquisition and Business Valuation Business so my perspective on stocks and related is quite different from other peoples. Basically most stock values are over valued in relation to their value as compared non-publicized traded companies values. Most entrepreneurs receive a much higher return on their investment in their own business. However since not everyone can own their business stocks and similar investments remain a very viable option for the majority of investors.

Investment decisions are about risk management, return on investment and asset allocation among other things. Having access to the right financial information and being able to take advantage of proven financial strategies such as dollar cost averaging, compounding and tax free growth financial instruments make a difference.

I read the whole blog its a good informative blog, but i am so confused that in which kind of stock we have to invest.

Those who sell in panic always sell cheap. You need to have control over emotions to be a good investor

Your design is so exclusive in comparison to other individuals I have study things from. Many thanks for publishing when you’ve got the chance,

Each and everyone wants to play safe now, given the current unstable time and risky market. Can’t blame them though. Thanks for the nice piece of writing.

Wow, beautiful post and article. Thank you for share with us. I have konwledge about a dress website. You can see some especial dress here.

The best thing you can do is to start early when looking into investing. It’s a hard thing to do when you’re young, but every windfall you have could go towards your future investments.

Getting an investment is a good idea but there are certain things that needs to be considered. For example, if you’re going to invest on real estate properties the location and market value should be considered first. Thanks for sharing your advice by the way.

Amazingly informative post ! .. Thanks for sharing with us .. :)

Apu

great share!! very informative post and with great ideas! your style is really different!! two thumbs up for this great work!! keep it up! :)

Good information on real estate investment.

I would also like to comment on your website’s layout. I am impressed.

I like reading and blogging about various Business and Marketing strategies.

Really nice post about real estate investment.I think the key take-away that homeowners should recognize is that housing is not an investment vehicle. While yes, it is possible to make money in real estate, it extremely risky in today’s market.

I think investment advice all depends on your situation. depending on your risk levels and the amount you can invest.

I like your sidebar and website design its very different.

Ethan

Very nice post. The market is a huge risk if you don’t do it right. Thanks for sharing this information.

Nice post. thank you for sharing with us. I think it would be effective for all which people are want to sale their home. I like this post indeed.

Hello Leon,

What strategy will you really recommend as the best strategy for option trading.

I have not heard much success with most of the fundamental strategy. And you know we must be wise and make decision as quick as possible in this type of market. It is a volatile market that much emphasis must be place on a number of factors.

What will you really recommend?

Thankd

James, I am not a fan of stock trading, unless you are doing it for a living. And, Options trading is even more volatile than stock trading. That said, I believe options can be used effectively to hedge positions, or to create a disciplined trading strategy. For example as a hedge, buying puts against a large stock portfolio would provide some insurance against a market slide. The other example, creating a disciplined trading strategy, stems from investors unwillingness to get out of trading positions at a set loss. We tend to hold on to losers and watch them become bigger losers. Thus buying calls or puts, could be a fixed limited loss position when trading a belief that a stock position would go up or down, within the given time period. Again, the challenge of picking the direction of a stock within a given time frame is extremely difficult for mere mortals. The better trading strategy using options might be to find some way to be on the sell side, with hedged positions. Sale of options generally are more profitable than purchase.

There are lots of great books helping to identify neutral or lower risk option strategies. Of course, there are significant risks, and trading options should only be undertaken with a limited portion of your portfolio, and only when you really understand the dynamics of how the options themselves behave over time. It is a market where the pros have a distinct advantage.

Good luck James.

Frankly speaking market now is only for traders & not investors. With uncertainty in the air every one wants to play safe & lock in profits daily.

Leon,

I basically use fundamental analysis to validate the direction I think the market is going in, then I further use it to evaluate the stocks in my watch list which I evaluate daily.

If the market fundamentals are bullish I look for stocks showing strength. If the market is bearish I look for stocks showing weakness.

Once I have candidates based on fundamental analysis, I look for certain price patterns which I have had success with. May favorite chart patterns are channels, ascending triangles, descending triangles, and generally strong support and resistance levels.

If I’m bullish and a stock is rebounding off support, then I make a bullish trade.

I wrote a couple articles on my site showing how I break this down.

But, basically – don’t go against the market, but if you do…be VERY sure on the stock you are going after.

I also pay attention to the news. Things like Tapering, Syria, Debt Ceiling, terror threats, earnings, elections, can have a huge impact on the stock so you have to be ready to react accordingly.

Let me know if you have questions on my strategy.

Also, feel free to check out my performance on my site in my options trading section.

Dale, I take it you are a professional investor and advisor, which could be an advantage. I think some pro’s have a reasonable advantage over an amateur investor, but not all pros are good or consistent at beating the market. For me, the struggle has always been in identifying and sticking with a pro through their ups and downs. Studies have shown that investors select a pro thats hot, when their streak is about to end, and walk away when they are down and the streak is about to begin again. In other words, most of us buy at the top and sell at the bottom. The other problem is that as a pro becomes successful, they are overwhelmed by funds which makes their niche strategies harder to work effectively.

Your approach sounds very well reasoned! I will check out your performance and wish you the best.

Leon

Actually, I’m not a professional trader but I eat, sleep and breathe stock options and the stock market.

I’ve been at this on almost a daily basis for over 13 years. And although I’m not a millionaire I have learned quite a lot.

There are probably hundreds of indicators and chart patterns out there but to be successful you need to stick with a few that work most consistently. You don’t need to buy $1200 software and depending on your strategy you do not need to to get the BEST real time quotes either.

Right now the market is going up, but not based on solid fundamentals. These conditions are not good to buy stock indices because a REAL drop could come at any moment. Everyone (traders) is way too optimistic at the moment. The government shut down, markets kept going up. Numbers come in below expectations, markets keep going up….that shows a big disconnect with the stock market and reality..it can’t last.

Based on past experience when the markets get to this level of optimism….when EVERYONE is on board thinking the market will ONLY go higher….that’s when the reversal is coming. I’ve seen this happen with the DOTCOM crash, seen it happen with the REAL ESTATE crash and it is only a matter of time before it happens with this current bubble.

Matthew Wade is right in that a good strategy is to be in and out…OR go for stocks that are trading somewhat predictably.

For example…under normal circumstances MSFT is unlikely to soar to $60 overnight. They are also unlikely to drop to $11 overnight. Same for INTC, and YHOO. These are good neutral strategy stocks.

APPLE, GOOG, PCLN would be good stocks for strategies playing on volatility. I add stocks like these to my watch list and look for the proper entry positions.

In the event that the circumstances are not normal you have to be disciplined at cut your losses and wait for the next opportunity. Hanging on to losses is how you lose everything. Been there too.

Most importantly…you have to learn money management, and to take your emotions out of the equation.

Dale

Dale, I do think you are right about the market being valued very optimistically. Of course, over the years we have seen markets go from being overvalued to being outrageously overvalued. The correction is never pretty. Right now, I agree that one should be extremely cautious.

It’s interesting that you should mention AAPL, GOOG and PCLN. These are fantastic businesses and interesting stocks. I have owned AAPL for more than a dozen years, adding to my holdings over that time. Even though the stock has risen dramatically, it is the most undervalued it has ever been, right now at around $520.

You are absolutely right about being disciplined about losses. My greatest losers have been ones I held onto hoping they would come back.

Have you considered using a market neutral strategy, such as shorting overvalued, while long undervalued? This should eliminate the market effect, leaving the element of stock picking as the primary determinant of return. In a market like today, one would then overweight the short. I think its worth exploring.

Best wishes.

For options trading (my primary strategy for the stock market) I have used some market neutral strategies. The ones that seem to work well are Iron condors. Iron condors are VERY popular among options traders. You make money from this if the markets are relatively range bound. If it goes outside your range you start to lose money.

I got burned a couple times trying to use this strategy for THIS market because it is not range bound at the moment. As with any strategy though you need to have the right underlying conditions for THAT strategy. Of course, there are other methods like collars, straddles and strangles but I don’t want to get too crazy with what I do. I focus on certain types of strategies and learn the ins and outs of those. Different things work for different personalities and different market conditions.

I prefer credit type trades where I get the money upfront and then it’s just a matter of waiting for the options to expire worthless…as opposed to setting up a trade and “needing” the stock to do something for me to realize a profit.

I usually have some cushion (for loss) built in to my trades. So I make money if the stock goes up, stays flat, or goes down. I only start to lose if the stock moves against me significantly.

For options trading (my primary strategy for the stock market) I have used some market neutral strategies. The ones that seem to work well are Iron condors. Iron condors are VERY popular among options traders. You make money from this if the markets are relatively range bound. If it goes outside your range you start to lose money.

I got burned a couple times trying to use this strategy for THIS market because it is not range bound at the moment.

As with any strategy you need to have the right underlying conditions for THAT strategy. Of course, there are other methods like collars, straddles and strangles but I don’t want to get too crazy with what I do. I focus on certain types of strategies and learn the ins and outs of those.

Different things work for different personalities and different market conditions. I prefer credit type trades where I get the money upfront and then it’s just a matter of waiting for the options to expire worthless…as opposed to setting up a trade and “needing” the stock to do something for me to realize a profit. I usually have some cushion (for loss) built in to my trades. So I make money if the stock goes up, stays flat, or goes down.

I only start to lose if the stock moves against me significantly.

I think Dale is bang on the money – and these are indeed worrying times given this (artificially created) bubble we’re seeing.

The medicine the banks and governments have been feeding the markets to fix our economies is 6 months at best away from causing so much more harm than the ailment it was intended to fix.

Sometimes (like now) it really DOES seem that the alarmists and contrarians have a good point.

I think that at the moment circumstances are anything but normal and for now it’s not so much about making gains from investments but simply making sure you’ll be able to hold on to what you can.

P.S: I’m long on physical gold if you didn’t guess ;)

Emma, thanks for your comment. I must admit that I have never quite bought into the gold hedge theory. I see it primarily as a speculative commodity rather than a great inflation or market valuation hedge. In fact, the correlation between gold and stock returns is very low, except for very short periods of time. The problem is knowing when those periods will occur. So far, I have not been able to find a great hedge for an overvalued market, other than reducing my level of exposure.

Good points. Bill (William) Oneil over at Investors Business Daily is also a good resource to follow.

I’ve found that the most successful and consistent trading strategies use a combination of technical AND fundamental analysis.

Using just one of the two methods is not as effective as using both.

Dale, thanks for visiting and commenting. I agree whole that using a combination is a good way to go. Fundamentals represent the logical view of valuation, while technical represents the behavioral view of the market. There is a battle that takes place between those two camps particularly at the extremes of valuation. However, its hard to figure out when one camp strength will break down and the other overtake. I have often thought about building some predictive models around this concept, but have not had the time to do it. What is your method for combining the two disciplines?

Leon

Your style is so unique compared to other people I have

read stuff from. Many thanks for posting when you’ve got the opportunity,

Guess I will just book mark this site.

That chart showing the returns when you remove the worst performing days is striking to me. For most average investors though, trying to time the market can be very difficult. Wouldn’t you agree that a buy and hold strategy is best for most average investors/

For me time is the biggest factor you will need when it comes to stock market investments. If you start early and take advantage of cost averaging and compounding you surely earn big amounts of money in the future.

Update: On the Friday following Thanksgiving the SPX opened at 1161.41, and closed at 1158.66, slightly down. Goes to show that historical data mining to find statistics that show a preponderance for going up has nothing to do with what the market will do in the future!